Financial planning for retirement

Let’s face it. The financial services industry as a whole has done a pretty good job at educating on the growth side of investing. The constant attention of high flying tech names, the continual allure of a quick dollar as the update of new market highs seemingly continue to echo on the television.

The financial markets can be a fun place to hang around. But what happens when retirement is approaching and the margin for error is no longer like it used to be. In retirement, there are now consequences of flying too close to the sun.

The financial industry does a great job of pushing the greed and fear through everyone, but has done very little to truly prepare investors as they look to their retirement income phase. The rules are different and the window of opportunity slowly decreases.

Think of this scenario; Mom and Dad might have gotten through the years buying a couple stocks here and there, maybe hold a mutual fund or two, but overall pretty hands off about their decisions. As they get towards retirement they know they have to get it right so they reach out for help to build a proper plan.

This is great and we are huge believers of financial planning, especially heading into retirement. But for some strange reason (the media), this couple setting themselves up for retirement have a misconception that the market averages matter for their retirement. It’s a funny misconception but we see it time and again. Don’t get me wrong, historic market averages are important, but they must be used in context and for the right reason.

Let’s discuss.

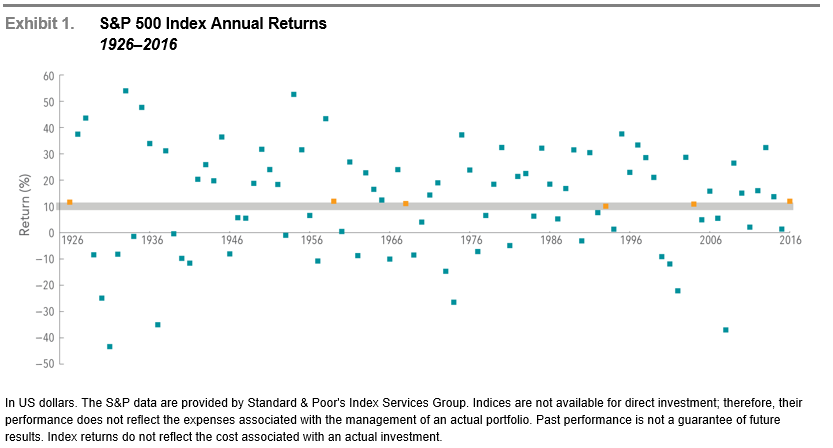

For simplicity sake, the S&P 500 for the last 90 years (1926-2016) has posted an annualized yearly return of about 10%*. Pretty good number; there isn’t a doubt in mind that long term, capitalism works and I as an investor want to benefit from it.

But, and there is a big but, short-term results more than likely will vary, and in any given year stock returns can be positive, negative, or flat. This is important because in that 90 year run, very rarely did the S&P 500 actually return 10%. In fact, only about six times.

Seeing the variability from a long term perspective is calming because you know the end result is 10% no matter the dot spray. But as an investor, rarely does this 90 year perspective keep one at ease with the world around us constantly giving us cues about tomorrow. These cues often enough trigger us to act emotionally and become reactive.

Let’s make this situation real. From December 31st 1999 to December 31st 2009, the S&P 500 had a negative return. Think about it, after 10 years of investing if you just held that index you were no better off, and by the way, you were now living through the financial crisis. Most folks weren’t thinking that long-term I’ll get my 10% if I hang tight, rather they wanted the heck out. At glance, it definitely felt like times were changing and maybe this S&P 500 wasn’t going to continue on the path we had historically been accustomed to.

It is always so much harder when the situation comes and it’s real money on the line, more importantly, your livelihood. This is why I believe so many people just can’t stomach the risk and sell off their portfolio.

Let’s transition a bit and make this relevant to your retirement. We know that market averages are something that are spewed out ad nauseum, and from experience I know investors are always comparing their return to that of the market. But when it comes to retirement, is the market average really what you should be shooting for? What we have to remember is that market average return isn’t a free lunch, you’re also exposed to the volatility.

Think of it this way, the stock market is an efficient vehicle for investing your money at a specified level of risk, in hopes of being rewarded for that risk you took.

What does that mean in English? A positive return isn’t guaranteed just because you are playing as we saw in the first decade of the new millennium. There is also an ugly side. What happens when the S&P 500 is down 37% in 2008 and you’re expected to carry on as if nothing is happening? We find that the average person planning for retirement, or is enjoying the fruits of retirement can’t handle that volatility of staying the course, and often head for the exits like a bad ride.

Why Market averages shouldn’t matter?

The answer is pretty simple yet many people overlook it. The average person preparing for retirement can’t handle the volatility that comes with average market returns. It’s just too much risk plain and simple. If you’re someone who can’t bear to see your portfolio potentially go down 40%, why would you invest in a strategy or compare your portfolio returns to that of the S&P 500? You are setting yourself up for failure because when markets get rocky, as they tend to do, your emotions will send you for a ride knowing your returns are tied to the markets every move.

As you begin to change your portfolio away from looking like the S&P 500 index, you are altering the potential return away from looking like the S&P; this is the way people try to “beat the market”. But we have to remember that there isn’t a free lunch, so doing so may add more risk to the overall portfolio yet may not guarantee any better returns.

We believe that when it comes to investing for retirement, as an advisory group it is crucial we set clients expectations. It is almost unbearable hearing stories of investors who cashed out at the worst possible time because they were ill-advised.

The best way to tackle a retirement portfolio

The first question I always have, what does retirement look like for you and your family? Understanding your goals, aspirations, spending needs is key. This means, no questions asked, you need a financial plan or projection to get a good idea of the cost to retire and don’t be scared to overshoot. It’s always better to have and not need, than need and not have.

Here is where we have two paths to take: either you’re already in retirement/about to retire, or you have a projected date into the future in which you want to retire. If you are still working, we can factor in money that would be saved, contributed to registered accounts, pension etc.

We now should be able to take that dollar amount and ask, what type of return my portfolio would need to provide me so my retirement is fully funded to roughly 91. What does that rate of return number look like?

This is where help from an advisor is key; because we do this every day, it’s easier to have a good sense of how your required rate of return looks like and be able to assess as an investor, what your risk profile look like. Sorry for my assumption earlier, but some people are okay with their portfolio off 40% in one year. That’s fine! But your required rate of return should help tell a better story.

Once we factor in your pension, Old age security, and all your investable assets, clients often need a lower rate of return based on the financial plan than what they assumed coming into the meeting. We talk to a lot of people that come in after watching a days’ worth of BNN and say, “we are only working with you if you can get us a return of 7% annually”. When I ask why 7%, I assume maybe they ran a financial plan and that’s the number they need. “No we did some research, and if we are paying an advisor we should be getting at least 7% a year”, as if it’s a test to my abilities.

This mindset is wrong, and it is an expectation set by modern media. Rather, if your personal situation is that we could fully fund your retirement with a 4% rate of return annually, why would you subject yourself to more risk for a higher return? Nine time out of 10, it’s not ego, it’s that you don’t have someone looking after your retirement planning that is educating you and laying out all the facts. Rather they believe too that their job is to bring you unbelievable returns because they are tuned into the same station you are.

All these scenarios are real, and I take these conversations very seriously because in my eyes, I believe there is an opportunity to educate and help these people to understand that market averages don’t matter. What matters is that they are happy, healthy, and that their money is working hard for them so they can reach all their goals in retirement?

Wishing everyone a good investment experience, and a fulfilling retirement!