Introduction

Over our 30 years, we have developed and refined our proprietary BPM Bridging Process which takes all the pieces of a client’s financial puzzle and puts them together into one clear picture to navigate where they are going.

Due to our clients typically being successful business owners, professionals and executives, they look for more than just a typical investment advisor. They essentially look for a personal CFO, a Complete Family Office, who can quarter-back every piece of the financial puzzle for their family.

Our process isn’t just about managing a client’s money; the BPM Bridging Process integrates every aspect of their lives into the process so they are liberated to focus on what truly matters.

Critical Financial Events

“A big part of financial freedom is having your heart and mind free from the what-ifs of life”

-Suzie Orman

The other part of the process that is important, it’s fluid and dynamic and it’s all encompassing. There are critical life events that occur that can render a financial plan obsolete.

Sale of a business, family illness, vacation home, retirement, first child, divorce, loss of a spouse, charitable donation, travel, change of heart.

These events are sometimes predictable and sometimes random and unexpected, but they always have a profound impact on client’s lives. They need to be able to react to critical financial events which affect or may affect their family.

Clients take comfort in knowing that our process can serve them no matter how complex their situation gets or what life throws at them.

Multi-Generational

Over our 30 years, we continue to refine our process by having a deep understanding of our clients needs and worries. Lots has changed in the past ten years, and we aren’t expecting it to slow down anytime soon. Our clients look to us to help build, protect and manage their wealth as their family navigates the changes as well.

Each generation has a different view on wealth and our process does not simply just focus on current wealth. Rather we want to establish our client’s legacy and share their values with the future generations ensuring they are not left to their own devices. Our process is constantly changing to ensure we are relevant earlier and earlier to the second and third generations incorporating them into the process.

Our Clients

We recognize that we are not all things to all people, nor do we expect to be. We are all things to some people and those people are our clients.

To ensure we can be all things to our clients, we have a very specific FIT process which helps us partner with clients we are best suited for. FIT is about working with likeminded people striving towards the same goals, and building a long-term relationship along the way.

Each person views wealth differently making every plan unique due to their underlying goals and aspirations. Because our strategy is not one size fits all, we have a process that helps define some of the concerns and services needed by a potential client to help us understand if we can help.

Our process delivers a deeper understanding of the complexities inherent to advising business families, professionals and executives. This unique understanding allows us to go beyond just managing their money.

Our goal is not to have everyone as a client, but rather work with people that our team and the BPM Bridging Process is best suited for.

Partnership Approach

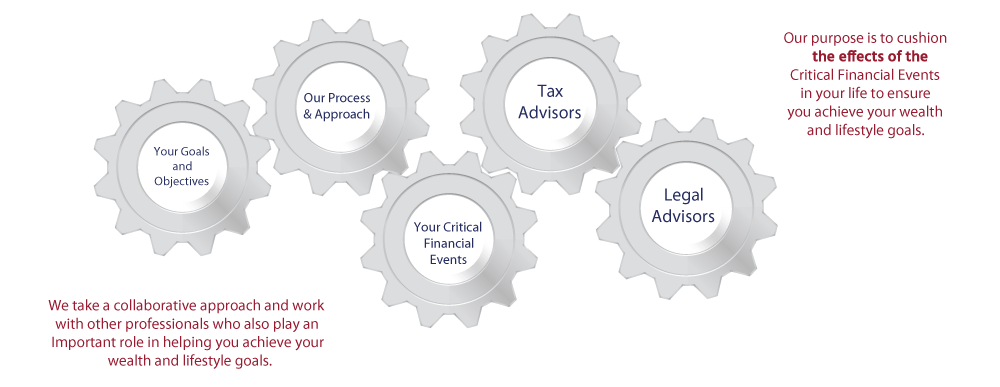

It becomes very tough to build a puzzle without the picture. Our process is designed to bring together all the pieces and give our clients the complete picture, then as their life unfolds and needs evolve we put all the pieces together.

To properly do this, we engage all of a client’s service providers (Legal, Tax etc.) to truly create a complete picture. There is a sense of freedom that comes when all your advising professionals work together and communicate free of needing a middle man to engage them.

Lastly, clients don’t have to worry about conflicting advice as everyone is on the same page and working towards their goals, leaving them to spend time on what matters.

New Client Process

To remain transparent and create an unparalleled experience, we disclose our New Client Process. The key while meeting with a new family is ensuring a good fit and the prospect of building long relationships; we also want our process to make clients comfortable and understand what they can expect.

When a new client can see and conceptualize the steps of our New Client Process, the conversation transitions from what we do for our clients to how can we help your family. Every relationship is unique in some way, that is why we have built into our process unique questions and activities like our What’s Important to You, not only helping us understand but also spark unique conversations not typically had at the dinner table.