As more Canadian millennials continue to make their way into their first big jobs in the corporate world, they are receiving larger incomes for the roles they are playing within their companies. In recent Economic Insights report put out by Stats Canada, millennials in the top 25% had a median net worth of $253,900 or more, and the top 10% with a median net worth of $588,582 (pg. 8, Economic Insights, Statistics Canada). These fulfilling big step comes after battling through the ranks of Post-Secondary, entry level positions and internships. But with more consistency in income comes the ability to take a step back and investigate the future.

The Millennial group is now the largest generation in Canada at 27% of the total population and having to ask themselves questions about what’s ahead and contemplate what will matter to future them. This group also has the highest debt to after-tax ratio among generations measured at any point in their life course, reaching 216%– over 1.7 times more than young Gen-Xers and 2.7 times more than young boomers (pg. 6, Economic Insights, Statistics Canada). While it’s easy to bury the head and pop back up when more serious decisions must be made, there are some key mindsets that one can adopt to provide a foundation to their financial well being.

Save like Crazy

As your pay cheques slowly continue to increase into the six figures, it’s natural to feel entitled to spend a little more to improve your lifestyle. While quality of life is important, it’s vital that you properly budget your spending and allocate your money wisely. This can be tough, but it pays to remember that serious wealth is created over many years and is a slow and unrewarding process in the early years. Unfortunately, tucking away 10% of your income a year doesn’t give you the same thrill of driving a sports car or buying the latest handbag. Due to this lack of an emotional response, it’s important to automate your savings. This can be done via pre-authorized account deposits allowing a set amount of money at a set period of time to be directed into a “no touch” investment or high interest savings account. This automatic withdrawal will remove both the work and the temptation to spend it, creating savings weekly, bi-weekly, monthly etc.

The key is to understand your inflection point between being able to maintain a level of lifestyle while maximizing the percentage of income you save on an annual basis.

Take Advantage of Compounding Interest

The eighth wonder of the world, compounding interest as noted by the late Albert Einstein. Understanding what compounding interest is, where to find it, and what it means to your wealth long-term is vital.

Compounding interest refers to the increasing value of an asset due to the interest earned on both principal and the accumulated interest. So, in more simplistic terms, receiving interest from not just your initial investment, but also on the growth of your money you’ve accumulated along the way. This idea is where you should focus as you build up your savings pot to ensure long-term growth.

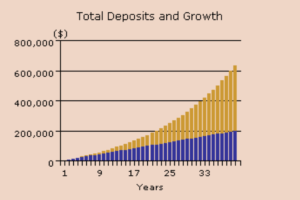

Let’s make these numbers real; let’s say you were able to save $5,000 per year and invest this money for a 5% return annually over 40 years. What would the results show?

Year one:

$5,000 deposited

$250 of growth

$5,250 year end value

Year five:

$5,000 deposited

$4,010 of growth

$29,010 year end value

Year forty:

$5,000 deposited

$434,199 of growth

$634,199 year end value

It is amazing what compounding your money can do over long periods of time. In this scenario, one would have deposited $200,000 throughout the years, but with compounding interest you’d see growth of those annual contributions equal to $434,199 with a final value of $634,199.

Now imagine what the numbers would look like if you saved 10 or 20 percent of your income over 40 years and had it compounding? Again, let’s make sense of what this could be. If one had an after-tax income of $90,000 and could comfortably save 10 or 20 percent of that, your balance at the end of the 40 years would be $1,449,967 or $2,899,169 respectively at a 5% rate of return. We would also have to assume your income would drift higher as progress through your career and saving 10% or 20% of your income could become a much larger number.

When you pair saving and investing with a long period of time, it is amazing the wealth you can create.

Ignore the Jones’s

It is inevitable that throughout your career, many different characters and external factors will come into play. Cue the co-worker that turned himself into a millionaire placing his life savings into Bitcoin; the neighbour that purchased the new Maserati; your friend at the golf course that has a once in a lifetime private investment opportunity. These scenarios show up in everyday life to derail our long-term plans.

While these are friends, family, co-workers, acquaintances and possibly even people you look up to, it’s important to ignore them when it comes to your financial well being. The Jones’s are the people that are making more money than you, have fancier things and make it seem like it all comes so easy. To the point where you want in as well.

Again, echoing the above topics; spending is the easy part and with today’s access to credit and loans, someone could spend far beyond their means. As a young professional that is working hard and has a competitive nature, this can feel like your income or lifestyle is falling behind.

Ignore the Jones’s and stick to the long term. Too often, early on people lack the financial education and discipline and find themselves jumping from idea to idea and end up creating no value for themselves in the long run.

Look for Professional Help

Over time, as you keep your head down and build your money, you may reach a level of wealth where hiring an investment advisor makes sense. As your life becomes more complex, your goals change.

The benefit to working with an advisor is they have a process and knowledge base you can lean on. It’s their job to understand you and your goals, build a plan that speaks to those goals, then help you execute. Beyond the planning, there are also efficiencies that exist when working with an investment advisor such as:

- Creating a portfolio that achieves a level of return within your risk tolerance

- Putting the right investments into TFSAs and RRSPs to avoid tax

- Ensure your investment management fees are cost effective

- Receive real-time advice to the things that matter the most in your life

- Help build a financial road map and keep you disciplined

- Ensure you are taking advantage of employee savings/retirement plans

While there is endless noise for Robo-Advisors and E Trade commercials that trigger young investors, think of this. These low-cost automated services remove the personal touch of advice that is personalized to you. Look at the workout industry; you can purchase workout videos and Apps for a relatively low cost each month. It is then on you to keep disciplined and execute daily to reach the goals you set out. On the other side, there is a personal trainer that costs you more, but provides specialized advice to your body and goals, but also pushes you and creates a driving force behind what you are doing.

Both systems work, and typically the goal of having financial freedom is the end game. It’s important to understand who you are as a person and which model fits better. Short-term at initial glance there may be a cost difference, but long-term is the name of the game.

Financial Independence

Having a goal and creating a financial plan or road map to get you there will ensure you know what is needed to save annually to get you to the end zone. While there are many vehicles to potentially get you there, it’s important to find the one that removes some of the uncertainty and provides a smooth ride.

Financial independence seems like the dream. It’s important to take small steps and properly manage your wealth, so your money can generate enough income to live off.

By working with a skilled advisor, you can remove the guesswork by creating a customized financial plan that factors in wealth and lifestyle goals, an investment strategy that speaks to your risk tolerance and desired rate of return, and lastly a partner that has your best interests at hand allowing you to focus on what your good at. The longer you wait to start this process, the less time your money must compound into potential massive wealth.

Start today and learn how you can maximize your wealth with a customized wealth plan and investment strategy.

References: Economic Insights, Economic Well-being Across Generations of Young Canadians: Are Millennials Better or Worse Off?, Heisz, Andrew. Richards, Elizabeth. Income Statistics Division and Analytical Studies Branch, Statistics Canada. April 18, 2019.

National Bank Financial – Wealth Management (NBFWM) is a division of National Bank Financial Inc. (NBF), as well as a trademark owned by National Bank of Canada (NBC) that is used under license by NBF. NBF is a member of the Investment Industry Regulatory Organization of Canada (IIROC) and the Canadian Investor Protection Fund (CIPF), and is a wholly-owned subsidiary of NBC, a public company listed on the Toronto Stock Exchange (TSX: NA). The particulars contained herein were obtained from sources we believe to be reliable but are not guaranteed by us and may be incomplete. The opinions expressed do not necessarily reflect those of NBF.