These days, planning for retirement isn’t just a luxury. It’s a necessity. Retirement has become too complex to just pick a day and stop showing up to work. And it’s more than complex—retirement is also expensive. You have to factor in expenses, taxes, and other spending. There are many ways to pay for it, but which ways are the best ways? How much do you need to save, and how should you invest?

Many pre-retirees don’t know the answers to these questions. As a result, there are several common mistakes they tend to make. Each mistake on its own can severely affect your retirement lifestyle. Making several mistakes at once can mean total derailment.

These mistakes are:

- Failing to have a proper retirement plan

- Having an improper asset allocation

- Lack of an investment process

- Falling prey to fraud and bad investments

- You’ll have to get to the end to discover

Take a moment to look at some of the most common issues we see. Are there any items that you have not yet planned for?

Unfortunately, retirement planning is a little more extensive than just a five bullet checklist. For simplicity, I have put together this list as a way for retirees as well as future retirees to touch quickly on the key areas we often find overlooked.

If there’s any chance you are feeling uneasy about any aspect of retirement listed above, it is important to find the time to understand your situation and find clarity. I’d be happy to speak with you so we can discuss how to turn potential mistakes into future strengths. In the meantime, here is more information on each one.

Mistake #1: Failing to Have a Proper Retirement Plan

“Failing to plan is planning to fail.”

I’m sure you’ve heard that saying many times before. Most people, when they hear it, nod their heads and think, “Good advice.” But when it comes to your money, are you taking it?

When it comes to your money—and your retirement especially—Ask yourself these questions:

Do you know where your income will come from after you retire? Do you know if it will be enough to meet expenses? Furthermore, do you have any idea how much you’ll actually need?

Have you decided what you want to do with your golden years? Have you figured out how you’ll pay for it?

Are your investments suitably liquid so you can meet any unexpected expenses? Do you have a plan for minimizing taxes, both for yourself and your heirs?

Have you planned for what could happen if your health goes bad, or your spouse passes away? Are your retirement accounts protected from inflation?

As we all know, life can be complex; but as we start factoring all these what-ifs of the future, there are often more moving parts than we can easily account for. So if you are unsure or never thought about some of the above points, it might be best to start with a general plan.

Option #1: fire up Google and get searching. Of course, you’ll have no way of knowing if the information you get is accurate, or if it’s appropriate for you. And it could take weeks of fruitless searching to find the answers to your questions. Many of the articles out there are really just stubs—they give you a few basic points, but almost no details at all. Most are shorter than this report.

Option #2 is much more promising: actually create a financial plan. A proper plan made with the help of a trusted third party advisor, defining important aspects that will improve the probability of a successful retirement.

Know how much money you’ll need to meet your expenses and reach your goals.

Know where that money can and should come from. Having a plan can show you how much income you need, how much you should save, and what expenses might need to be cut.

Choose the right investments to provide the income you need, at a suitable level of risk. Calculate the tax consequences of retirement and help maximize your Canadian Pension benefits.

Potentially minimize taxes for both yourself and your heirs.

See what areas of your finances are stable and which may need improvement.

Having a financial plan provides peace of mind. It answers questions. But most of all, it’s an instruction manual to assembling your own retirement. Planning ahead is the ultimate path to success.

Mistake #2: Having Improper Asset Allocation

Improper asset allocation is one of the most common mistakes that a pre-retiree can make. Why is asset allocation so important? Look at it this way: if you were to only eat one food every day for your entire life, your body would be very unhealthy. If you were to exercise only one group of muscles for your entire life, your body as a whole would be very weak. And if you were to invest all your money in a single asset class, the same would be true of your finances.

Asset allocation is basically a strategy that spreads your investments across different “asset classes.” The three main classes are equities (stocks), fixed income (bonds), and cash. There are other classes, of course, like commodities and real estate. And there are sub-classes as well.

The thinking behind asset allocation is that by taking broad exposure in your investments within these different classes, you take on less risk by spreading out your exposure. If one class goes down in value, the other classes you’ve invested in may compensate.

Not only does a good asset allocation help mitigate risk, but it also helps align the expected rate of return of the portfolio. As an investor, you expect to be compensated or rewarded for the level of risk you take. This again begins with the risk asset allocation. Think of it this way, a portfolio with 100% stocks would expect to create a high level of return compared to a portfolio with 100% bonds, all things being equal. Finding the right combination of stocks, bonds and cash is not a guessing game; finding the right fit with your allocation requires multiple factors:

- What is your required rate of return from your financial plan, after factoring the amount of funding you will need to enjoy life at the minimum until your 90 at least (don’t want to live longer than your money)

- What is your risk tolerance, or in english, if we were to go through a recession or financial issues, what percentage of losses of your investment portfolio would cause you to lose sleep

- Do you have any expected large financial events coming up in your life (expecting a baby, new house, tax bill, recreational property, new car, sale of a business etc.) that will require access to money or a liquidity event

We can take this a step deeper to say the most common mistake we see when working with new clients looking their asset allocation is their existing bias for Canadian investments. We know for a fact that Canada makes up approximately 3% of the global market capitalization, yet on average Canadian securities make up for more than 50% of our portfolios as Canadians (1).

- Vanguard Investments Canada, Home Bias and the Canadian Investor, 2018

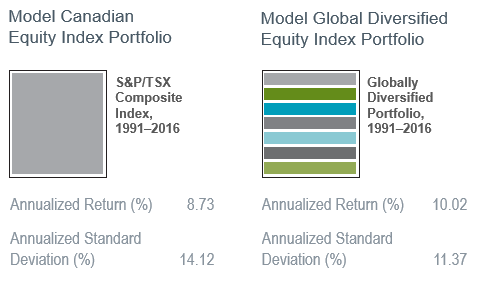

Source: Dimensional Fund Advisors, A different way to invest

What this means is Canadians are often overlooking 97% of the rest of the worlds investable assets to remain in Canada. The above chart shows us what an equity portfolio strictly in Canada looks like vs. the Global counterpart from 1991-2016 as per Dimensional. It is easy to see at first glance that the Global portfolio outperformed 10.02% annualized against the Canadian only holdings of 8.73% annualized. Clearly, as a whole, the globe has outperformed just Canada as a country.

But often forgotten is the Annualized Standard deviation one of the key fundamental risk metrics which measures the volatility of the underlying holdings returns in relation to its average return. In this case, the returns can be more variable (higher standard deviation) when holding strictly Canadian equity names in comparison to having a globally diversified portfolio. What this means is that not only does the global market as a whole perform better than just Canada, but one would also benefit from the added diversification. This is a win-win scenario, yet Canadians still hold 50% of their marketable securities in domestic holdings. In my opinion, I believe this is a result of advisors not properly educating them as it’s tough to turn down a better chance at a higher return with less bumps along the way.

Asset allocation is key when setting yourself up right to retire. Educating yourself and having your interests put first is crucial, and a big part of how an advisor can align you and your family’s interests so you’re left an asset allocation that you feel confident about and a process to help you stick to your guns, even in tough markets.

Mistake #3: Falling prey to fraud and or bad investments

ONE OF THE BIGGEST DANGERS TO YOUR RETIREMENT IS FALLING PREY TO FINANCIAL FRAUD!

I’ll take this one further; falling for speculative, high potential investments that end up as flops, effectively are destructive to your wealth and psyche when it comes to taking risk. Fraud or a bad tip, they have the same effect on your wealth, just a different justification on what went wrong.

You might be thinking, “That will never happen to me.” If so, I hope it never will. But don’t we say the same thing about car accidents? About break-ins? About … anything? Yet we still wear our seatbelts when we drive; we still lock our house when we go out. Even if we think these things will never happen, we still take precautions against them. It’s those precautions that actually prevent bad things from happening.

Fraud should be no different. We may think it will never happen, but only by taking precautions can we ensure that it never will.

Rather than go through an expansive list of potential risks and how to avoid these issues, I would prefer to point your attention to key bullets and provide insight into how you should be processing new information.

- Email fraud asking for money

- Telephone fraud phishing for information

- Hot investment tips from a friend at the health club

- Password protection online

- Rush decisions that need prompt commitment

- General investment advice that seems too good to be true

- Deferred sales charge mutual funds causing a “selling penalty”

There are more things to be weary of than this list, but these are some of the keys to be on the watch for. Having a process to approaching these potential bumps in the road will help improve your chances of avoiding mistakes.

Understanding that you could be a target is important. This will ensure your always watching. The goal isn’t to be over skeptical, but develop “Spidey senses” when you feel like something doesn’t feel right. It is essential that you have a trusted and knowledgeable back stop that you can bounce some of these topics off. The key for this person is that they don’t have a vested interest in whatever the topic may be.

For example, it isn’t helpful turning to your friend or associate on a potential private investment when they themselves are invested or are emotionally involved. Rather, a strong recommendation is to have a third party advisor that holds themselves to a fiduciary standard, meaning they put your interests before their own. This relationship is important to a household because not everything is fraudulent or a bad decision. Having a trusted advisor that you can pick up the phone to talk about anything, gives the comfort and security that you’re not facing things on your own.

It is important that you as an individual, family or company come up with a process when these opportunities/situations arise. Who is our advisor that can educate us more on the topic and connect us with an expert in the area? Do we have a strategy to understand if something passes the smell test? What is our risk management strategy? As a family, are we willing to take on private investments? Who is our point of contact for all of our banking needs? What do we do if something doesn’t pass our two or three channels of back checking?

Again this might be simplistic, but its purpose is to get you thinking. For us, we use processes to help us make consistent decisions, remove emotions, and most importantly help give us guidelines. We have had the most benefit from our investment process because we understand mistakes happen; processes allow us to document what went wrong and set guidelines to ensure we don’t repeat ourselves.

We ensure that all clients know that we can be their first call on all things financial. Our job is as much about making wise planning and investment choices as it is about risk management. We commit ourselves to understanding what clients are looking at and being the gatekeeper to their hard earned wealth.

Ultimately, do your research before letting someone else touch your money. Investing your assets is a matter of being smart, prudent, and patient. It’s better to miss out on the perfect opportunity than fall victim to the perfect crime.

Mistake #4: Lacking an investment process

Process; I am using this word again. Having a process around how you invest, your philosophy or beliefs are extremely important.

Let’s take a step back. There are two things that drive our investment decisions. Greed and Fear. We make financial decisions with two things in mind, I am either going to make money, or I am doing something so I don’t lose money.

It is very simple and often overlooked. Think to a time where the emotions of greed or fear clouded your decision. I am hoping that something comes to mind, but I know when working with clients, this is something we face daily. Emotionally charged investments usually don’t lead to successful experiences because decisions are made in the heat of the moment. What you originally thought was a good investment can change in an instant with headline news, something read online, a second opinion. No matter what it is, lacking that understanding of what your process is will deter your experience.

This is the same for mutual fund holders. They know they have them, they know they are invested, but how or in what is a different story, never mind how much they are charging you in management fees. It is important to have a basic understanding or education of why you’re invested in a specific way. This leads back to making mistakes on rule number two, having an improper asset allocation.

Having an investment process, or working with a group that will have built your investment process will simplify your thinking when it comes to your money. It will no longer be about how much money can we make, or how much will this save me. Rather, the question is asked, “How does this fit into my investment process?”

Will something complement what we are doing, or have the potential to derail? Once you have a process, the conversation changes.

Think of it this way;

- If we have built out your Retirement Plan/Financial plan, we now understand everything financially and come up with a rate of return needed on your investments to reach your retirement goals

- From there, we can see what type of asset allocation you would need to satisfy that type of rate of return and see if it is within your risk level. If you require a higher rate of return than the level of risk you’re willing to take, we have to go back to step one and see where we can adjust or find the savings

- Once those two steps are set up, it is about managing the process. This means whenever there is a change needed or a new opportunity, we always ask, what does that mean to your asset allocation and how does it affect your retirement plan. Buying that hot gold stock will now have consequences of altering your asset allocation, and then also has the potential to create change on your retirement plan. Once it is framed in this mindset we find most people are much less eager to jump on these hot tips and ideas.

- Lastly, having an investment process removes emotions, puts things in context to your ultimate vision, and leads to a higher probability to having a good investment experience.

Mistake #5: Not dreaming about all the amazing things retirement can be!

This is the last mistake, and while I’m about to have some fun with this one, it’s no less important than all the others.

Retirement is about finally having the opportunity to focus on living. It’s no longer about getting ahead in life, but about experiencing life itself. For that reason, retirement should be fun. It should be enlightening. It should be rejuvenating. Above all, retirement should be … whatever it is you want it to be!

However, there are many people who never take the time to dream. They never create their bucket list or ponder their deepest, sweetest desires. It’s quite possible to spend too much time worrying about how to retire and not enough on why you’re retiring, or what you want to do in retirement. People who make this mistake run the risk of experiencing the worst scenario of all:

Boredom.

“If you can dream it, we can help you outline the path to get there.”

So start today. Close your eyes and dream. Assume for the moment that you’ll have both the money and the time. What do you envision yourself doing?